Bankroll Revolving Lines of Credit for Businesses in the United States

Bankroll Revolving Lines of Credit for Businesses in the United States

Ground Zero Funding is excited to introduce our latest product, BANKROLL, the ultimate revolving line of credit for business owners in the United States! We understand that having the flexibility to access capital while keeping cash flow stable is crucial for business owners. With BANKROLL, we provide merchants their MAX loan amount (up to $1,000,000), a fixed loan term (up to 36 months), and a fixed weekly payment, plus the flexibility to pay down or borrow additional funds on an unlimited basis.

With BANKROLL, you are in complete control based on your unique business needs that may change over time. You decide when you want to borrow, how much you want to borrow, the size of your payment, how much in finance charges you will pay, and how long to keep the loan. Our product provides early payoff without penalty anytime during the loan, giving you the freedom to manage your finances with ease.

At Ground Zero Funding, we strive to provide the best financing solutions to help businesses grow and succeed. With BANKROLL, you can access the capital you need while keeping your cash flow stable. Contact us today to learn more about how BANKROLL can benefit your business in your local community.

Bigger is Better!

Larger Loan Amounts, Longer Terms & Big Rewards

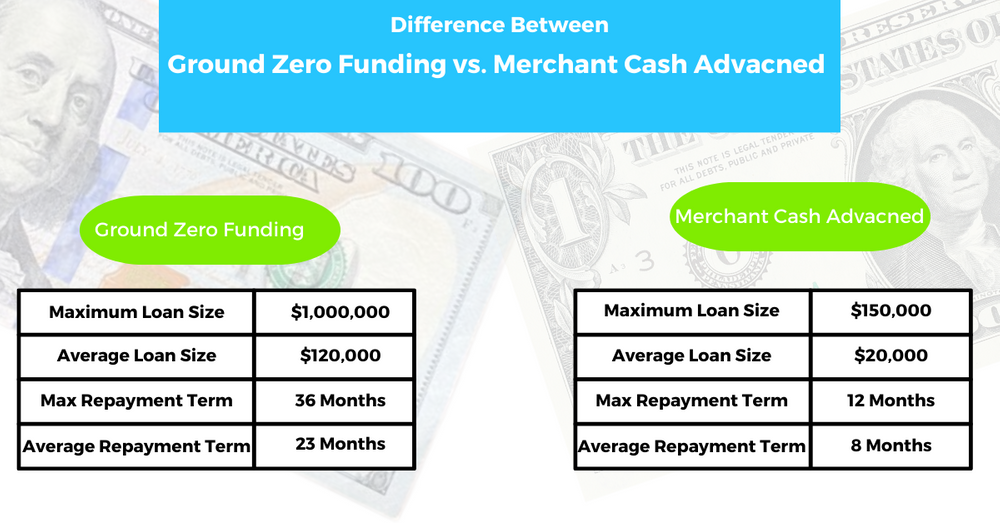

Big projects require significant upfront investments that merchant cash advances can't provide. Ground Zero Funding offers financing options that fit your big project needs. You can now access loans up to $1,000,000 with repayment terms up to 36 months, keeping your costs low. Compared to a merchant cash advance, our average loan size is over six times larger and repayment terms are more than three times longer. With larger loan amounts, you can invest in growth opportunities that will have a significant impact on your bottom line. Longer repayment terms make your payments manageable and won't disrupt your cash flow.

Completing an application only takes 10 minutes and won’t affect your credit.

What Is A Revolving Line of Credit?

Ground Zero Funding's Revolving Line of Credit is similar to a credit card, with a maximum credit limit that you can access for business purposes at any time during the revolving period, which is up to one year. To keep the revolving period open, a minimum $5,000 loan balance is required at all times. You may take unlimited draws or make partial principal paydowns of $5,000 or more during the revolving period. Every weekly payment and partial principal paydown frees up your line's available funds.

However, unlike a credit card, there is a fixed weekly payment based on the original term chosen during the approval, which can be up to 36 months. When you make payments on the revolving credit line, those funds become available to access again. You can use the credit limit repeatedly as long as you do not exceed the maximum.

Revolving lines of credit are commonly used by small business owners and corporations to finance expansion projects, additional locations, new equipment, partner buyouts, or as a safeguard in the event of cash flow problems. If you're a business owner in The United States, Ground Zero Funding can provide you with a flexible and convenient revolving line of credit to help you achieve your business goals.

Use of Funds

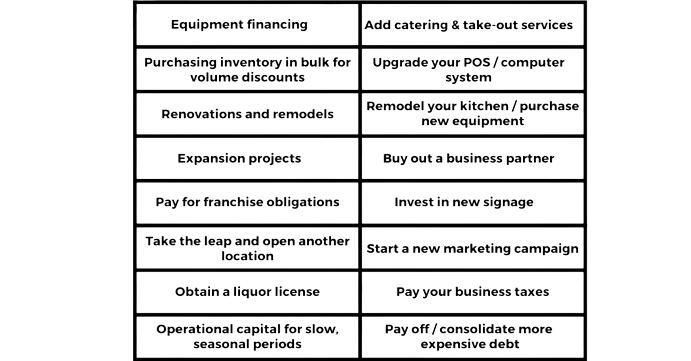

At Ground Zero Funding, we recognize the dynamic nature of the business environment, especially in the restaurant industry. Therefore, small business proprietors utilize our revolving line of credit for various business purposes. Revolving lines of credit are perfect for restaurateurs who are enjoying robust performance but require an infusion of capital to leverage growth opportunities, without surrendering equity. Business owners are aware that opportunities or challenges can arise swiftly, and having a reliable revolving line of credit enables them to be prepared for unforeseen circumstances.

Below are a few instances of how restaurant and small business owners put the funds to use